“Rent Burdened”? | One Paycheck Away? | Already There in the Lakes Region!

46.7% Of NH residents are “Rent Burdened” = Eviction Increases = HOUSELESSNESS | So Let’s Do Some Simple Math, and Between 2020 to 2024 — HOUSLESSNESS Increased 49.5%

Yesterday’s Blog Post “Dehumanizing Houseless? — Is THIS ONLY WAY to “restore” a community in the Lakes Region?” detailed the July 24, 2025 Executive Order 2025-14391 … which stated and implied HOUSELESS increases in America are the result of illicit drug use by members of HOUSELESS in our communities. Let’s be clear. While some HOUSELESS in the Lakes Region may participate in illicit drug usage; not only is that same usage true for those who currently live in a house and those who distribute illicit drugs — but it is a logical fallacy of a “sweeping generalization” — to state or imply — this to be “the root cause” of HOUSELESSNESS in the Lakes Region. WHY?

Rent Burden (GAP between Income and Affordable Rents) + Eviction Increases + No Affordable Housing =

A National Emergency of HOUSELESSNESS

This is now a primary “root cause” of the lack of affordable housing in mainstream discussions in the DC Beltway, in Concord, AND in the Lakes Region: WHY>

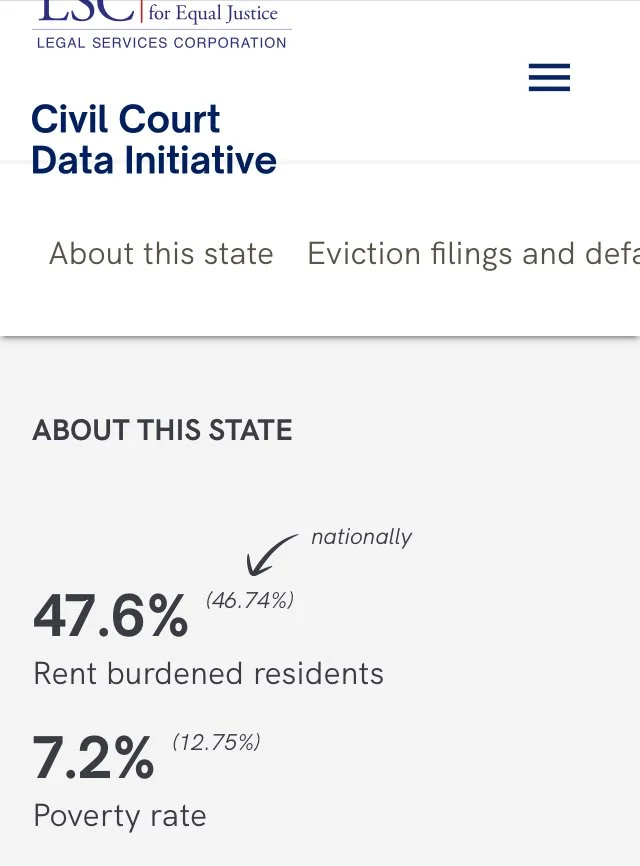

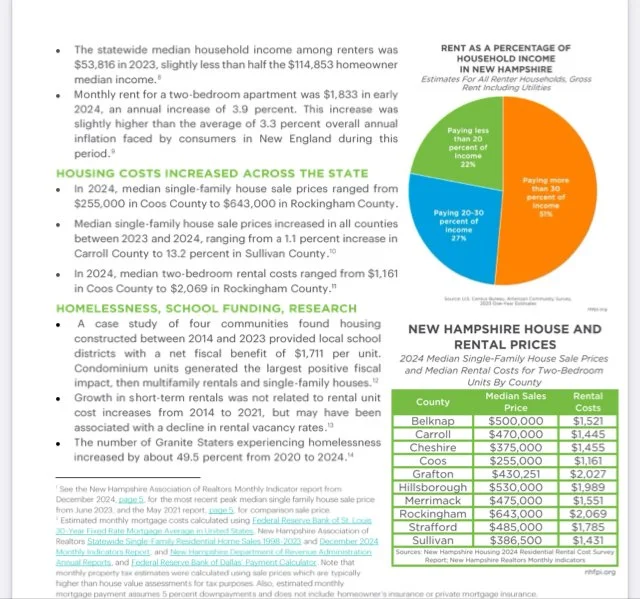

Simple Math: 47.6 % of NH Residents are “Rent Burdened” with Energy and other Cost Increases in NH Households

This primary “root cause” classification is not the mere opinion of the author of this Blog Post. It was in national headlines YESTERDAY regarding a National Emergency of Housing shortages:

What About Eviction Increases in New Hampshire from 2020 to Present?

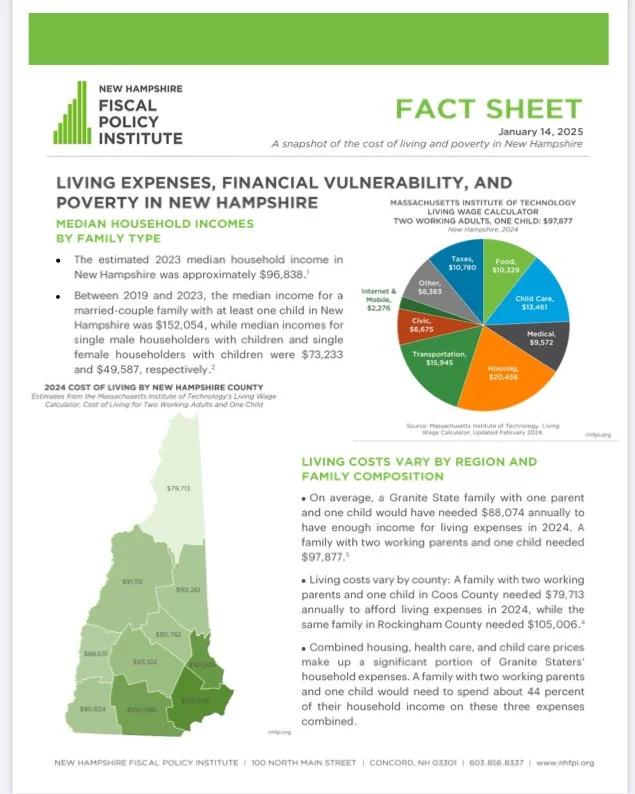

JANUARY 14, 2025, JANUARY 16, 2025

This fact sheet above provides a snapshot of financial hardships facing families in New Hampshire, including rising costs of living and varying rates of poverty.

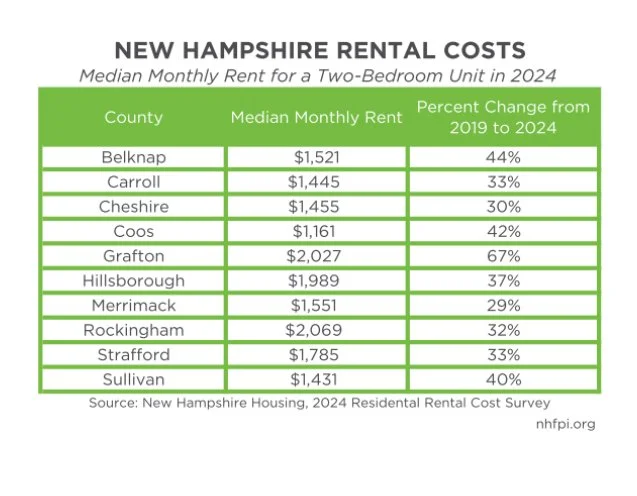

“Implications of the Current Rental Market

Rising housing costs increased financial strain on Granite Staters with low and moderate incomes. As of 2022, the median household income for homeowners in the state was almost double that of renters, at about $108,000 and approximately $56,000, respectively. According to New Hampshire Housing, only about 24 percent (https://www.nhhfa.org/wp-content/uploads/2024/08/NHH-2024-Residential-Rental-Cost-Survey-Report.pdf#page=8 ) of rental units in 2024 were affordable to those making the renter median household income of $56,814.

Based on wage data analyzed by New Hampshire Housing, out of 11 selected high-demand occupations, only nurses had median wages sufficient to afford rent and utilities for a two-bedroom unit in the state. Further, public school teachers and electricians were the only occupations that could afford one-bedroom unit based on median wages, while all other high-demand occupations, such as nursing assistants and construction laborers, earned median monthly wages lower than the median price for a one-bedroom unit. Renters are also more likely to pay more than 30 percent of their income towards housing costs, the amount defined by the U.S. Department of Housing and Urban Development as being cost-burdened by housing that functions as a simple but reliable (https://www.jchs.harvard.edu/sites/default/files/Harvard_JCHS_Herbert_Hermann_McCue_measuring_housing_affordability.pdf ) measure of affordability.

According to U.S. Census Bureau data (https://data.census.gov/table/ACSDT5Y2022.B25074?q=B25074&g=040XX00US33 ) from 2018 to 2022, nearly half (https://nhfpi.org/resource/nearly-half-of-new-hampshire-renters-are-cost-burdened-by-housing/ ) of renters in the Granite State were cost burdened by housing prices. Among those with a household income less than $35,000, about three out of four were paying more than 30 percent of their income towards rent.

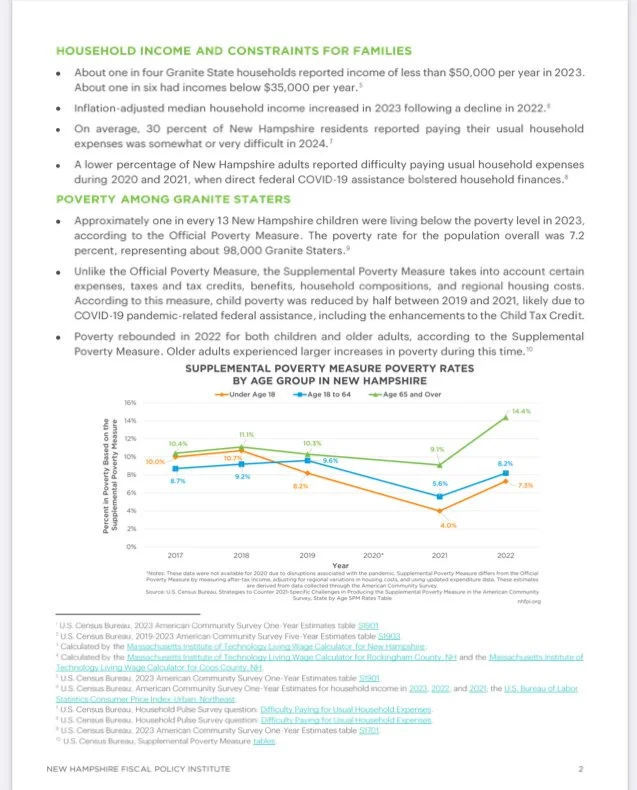

The increase in housing costs may have some association with the rise in eviction filings across the state, as more New Hampshire families with low incomes may face difficulty paying rent. According to the Eviction Lab at Princeton University (https://evictionlab.org/map/?m=modeled&c=p&b=efr&s=all&r=states&y=2018&z=3.51&lat=43.46&lon=-73.19&lang=en ), about 4.3 evictions were filed for every 100 Granite State renter households in 2018.

This rate was more than double the rate in neighboring Vermont (2.1), as well as higher than both Maine (2.8) and Massachusetts (3.5) that year. The total number of eviction writ filings in New Hampshire increased by about 66 percent from 3,742 filings (https://www.courts.nh.gov/sites/g/files/ehbemt471/files/inline-documents/sonh/lt-writ-filings-by-week-and-court.pdf ) in 2020, encompassing a temporary eviction moratorium (https://nhfpi.org/blog/eviction-moratorium-to-end-july-1-as-state-establishes-new-housing-assistance-program/ ) in New Hampshire followed by federally-funded rental assistance (https://nhfpi.org/resource/public-benefit-navigators-can-help-granite-staters-access-federal-assistance-and-support-the-economy/ ), to 6,221 (https://www.courts.nh.gov/sites/g/files/ehbemt471/files/inline-documents/sonh/lt-writ-filings-by-month-and-court-2023-12.pdf ) in 2023. The 2023 total was similar to 2019 pre-pandemic numbers (6,514 filings). (https://www.courts.nh.gov/sites/g/files/ehbemt471/files/inline-documents/sonh/lt-writ-filings-by-week-and-court-2019_0.pdf )

The increase in evictions may have contributed to the rise in homelessness.

From January 2022 to January 2023, the number of unhoused people in New Hampshire increased by about 52 percent, according to the U.S. Department of Housing and Urban Development’s point-in-time estimates (https://www.hudexchange.info/programs/hdx/pit-hic/#2024-pit-count-and-hic-guidance-and-training )”

https://nhfpi.org/resource/living-expenses-financial-vulnerability-and-poverty-in-new-hampshire-2/

OTHER LINKS:

New Hampshire Rental Costs Through 2024

The Number of HOUSELESS People in New Hampshire between 2020 to 2024 Increased by 49.5%