WHAT IF … “Rent Burdens” & “Debt Burdens” Just Vanished in the Lakes Region?

The Practicality of Historical Practices of Debt Forgiveness — “Clean Slate” Fiscal Amnesty

What does it Mean to be “Rent burdened” and “Debt burdened” in the Lakes Region in 2025?

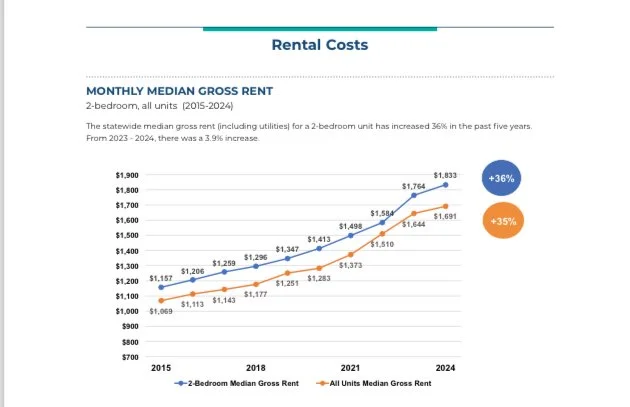

It’s difficult in the Lakes Region to scroll through “X”, Instagram, and YouTube feeds without being barraged with advertisements of debt consolidation, debt refinance, and credit repair schemes — all “crafted” to lower debt payments — as wages remain stagnant amid significantly rising prices of household necessities. The phrases “housing crisis”, “child care crisis”, “rent burdened”, “debt burdened”, and houselessness also have been appearing with alarming frequency in daily news cycles — as legislative responses focus on severely cutting back social services such as rental and energy assistance, and SNAP, WIC, EBT food relief.

The takeaway in this new blog post is simple. This crisis of these unsustainable financial burdens is not new and has occurred repeatedly before dating back over 4,000 years of our common history.

So what was different? Simple: Kings, Emperors, Legislators in various cycles declared a release of all total debts (fiscal debt amnesty) referred to below by others as a “Clean Slate” solution … short of facing a complete revolution of debtors.

What we will discuss:

One — 4,000 years of historical practices of debt forgiveness (described by others herein as: “Clean Slate” fiscal Debt Amnesty) across 11 ancient empires spanning 4,000 years of our common ancestral history;

Two — Thomas Jefferson and James Madison writings describing and agreeing National Debt is Not-Transferrable to Future Generations | Explained as a 20 Year Limit and as “Erosion of the Topsoil” to future generations| legal term: “Usufruct”; and

Three — Ramifications in the Lakes Region of providing a “Clean Slate” Total Debt Release to Americans.

Let’s begin with what one noted expert who has researched, practiced, and taught professionally for over 40 years on this subject matter.

BIO: Michael Hudson is President of The Institute for the Study of Long-Term Economic Trends (ISLET), a Wall Street Financial Analyst, Distinguished Research Professor of Economics at the University of Missouri, Kansas City. He is the author of Super-Imperialism: The Economic Strategy of American Empire (Editions 1968, 2003, 2021), ‘and forgive them their debts’(2018), J is for Junk Economics (2017), Killing the Host (2015), The Bubble and Beyond (2012), Trade, Development and Foreign Debt (1992 & 2009) and of The Myth of Aid (1971), amongst many others.

ISLET engages in research regarding domestic and international finance, national income and balance-sheet accounting with regard to real estate. We also engage in the economic history of the ancient Near East.

Michael acts as an economic advisor to governments worldwide including China, Iceland and Latvia on finance and tax law. He gives presentations on various topics at conferences and meetings and can be booked here. Listen to some of his many radio interviews to hear his hyperspeed analysis of the geo-political machinations of global economics. Travel costs and a per diem are appreciated.

A GENTLE CAVEAT TO READERS: I fully recognize time is at a premium in the Lakes Region. That admitted, this video is foundational to this blog post. It is over an hour long; however very little of this post will be meaningful to readers UNLESS this video is first watched from start through finish ALL THE WAY THROUGH.

HYPOTHETICAL EXAMPLE FOR CONSIDERATION:

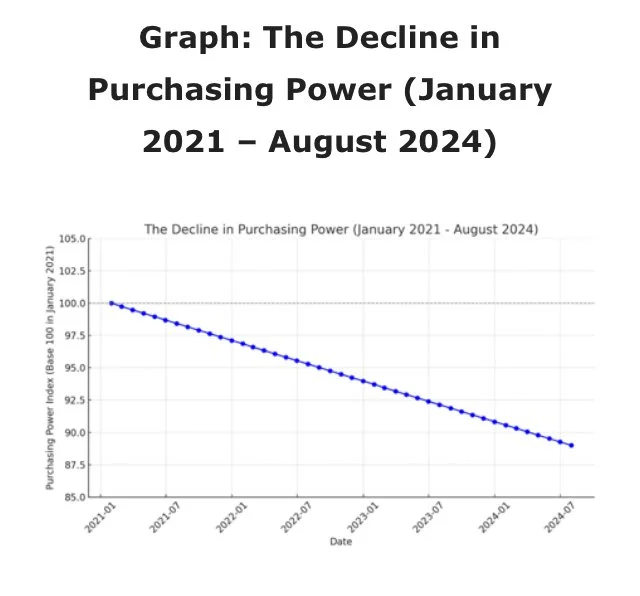

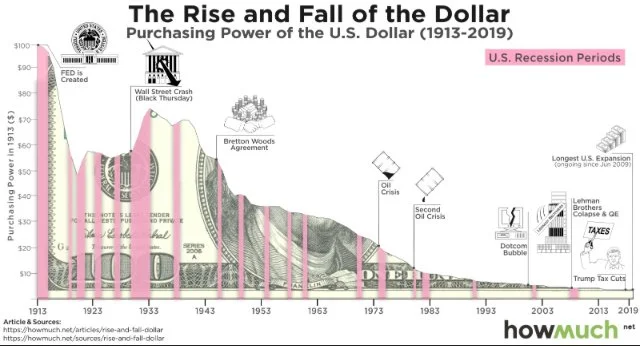

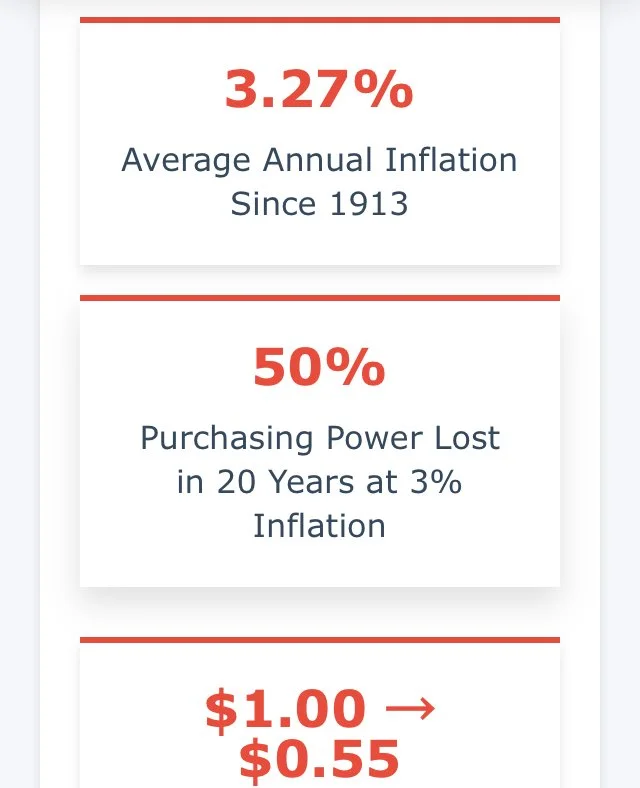

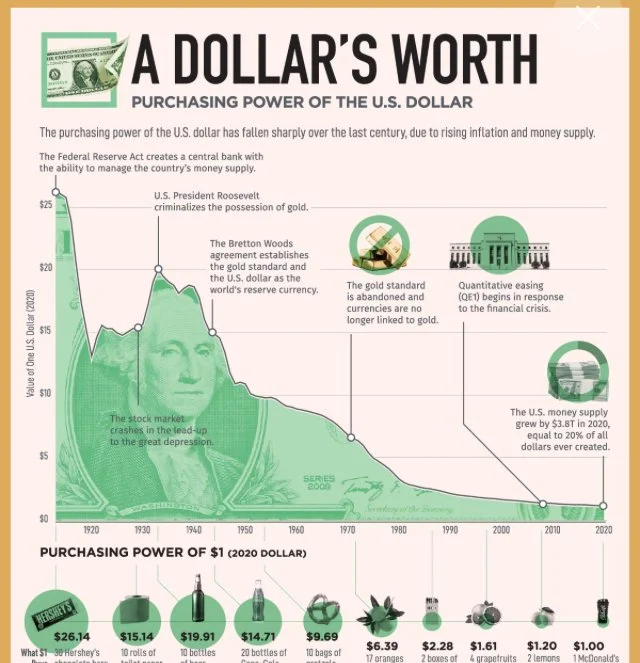

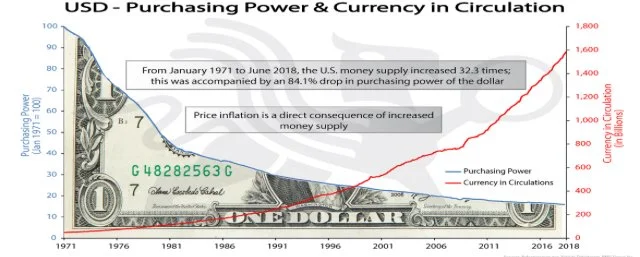

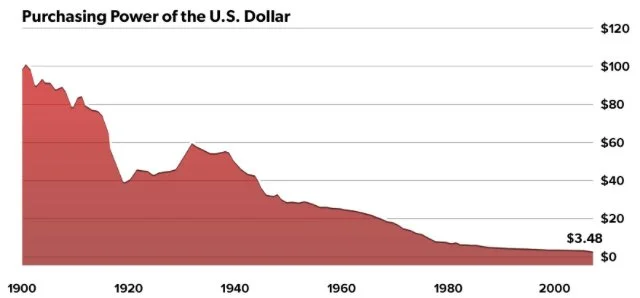

Suppose you entered into a mortgage in 2005 of a $350,000 house purchase at 5% interest, with Payments at $2,000/month. And then assume between 2005-2025, dollars you earned earned lost “purchasing power” of 40%/dollar meaning each dollar in 2025, as prices rose and wages remained stagnant — well —!those dollars bought 40% less groceries, energy utilities, child care costs … and other necessities.

One word would simply describe that as: “Unsustainable”.

So what did our common ancestors do (on a repeated cyclical basis) to “reset” this “unsustainability” to ward off a revolt of the people?

That answer may surprise you — not just with its historical, documented consistency — but also with the likely fact you were never taught this.

In a previous blog post we addressed 11 different empires and the striking similarities of their rises to power and their falls into the annals of history. “What do the Rise and Fall of 11 Previous Empires have to do with the Lakes Region? Turns out — Quite a Bit.” (Sept. 12) In that post we began with a discussion of an essay entitled: “THE FATE OF EMPIRES and SEARCH FOR SURVIVAL” by Sir John Glubb from the 1940’s, described in this short 11 minute video:

Summary of Michael Hudson’s book:

(SOURCE) In …and forgive them their debts, renowned professor of economics, Michael Hudson – and one of the few who could see the 2008 financial crisis coming – takes us on an epic journey through the economies of ancient civilizations. For the past 40 years in conjunction with the Harvard Peabody Museum, he and his colleagues have documented the archeological record and history of debt, and how societies have dealt with (or failed to deal with) the proliferation of debts that cannot be paid. In the pages of …and forgive them their debts, readers will discover shocking historical truths about how debt played a central role in shaping ancient societies. Perhaps most striking of all is that – in a nearly complete consensus of Assyriologists & biblical scholars – the Bible is preoccupied with debt, not sin.

In all eras – from antiquity to the present – debts have tended to mount up faster than the ability of most debtors to pay. That is a basic mathematical fact: Economic growth is arithmetic and can’t keep up with the exponential growth of debt growing at compound interest.

Ancient Debt Crisis Solutions: From Babylonian Clean Slates (mīšarum) to the Biblical Jubilee Year (deror)

Explore the revolutionary, centuries-long history of debt cancellation and financial clean slates in the Ancient Near East, a legacy rigorously researched by economist Michael Hudson in collaboration with mentors like Carl Lamberg-Karlovsky. This explainer video (slideshow below) details how rulers, from Sumer and Babylonia through the Biblical age, instituted debt jubilees to prevent economic polarization, maintain solvency, and keep the citizenry free from debt bondage and foreclosure.

Discover the sophisticated economic awareness of these ancient societies: Babylonian scribes were trained in the mathematics of compound interest, recognizing that debt accrues exponentially, faster than the rural economy can repay. To counter this inherent instability, rulers issued periodic proclamations of justice and equity.

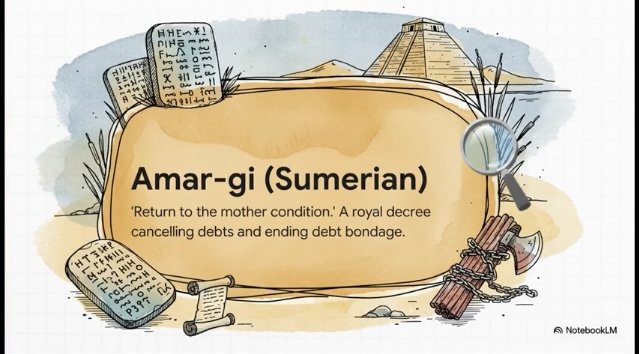

Learn the essential terminology and names associated with these acts:

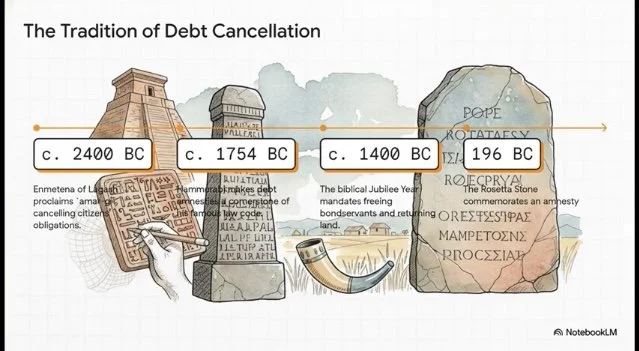

Sumerian rulers like Urukagina (c. 2350 BC) declared amar-gi, signifying a “return to the mother condition” or restoration of order, which involved cancelling debts and freeing bondservants.

Akkadian and Assyrian decrees utilized andurārum, and later Old Babylonian kings, including Hammurabi, Samsuiluna (1749 BC), and Ammisaduqa (1646 BC), proclaimed mīšarum to annul personal agrarian barley debts (but generally left commercial silver debts intact).

The video (slideshow below) traces this tradition through the Biblical Legacy. The Hebrew word for the debt release, deror, is cognate to andurārum. This concept forms the core of the Jubilee Year (Leviticus 25), which mandated periodic debt cancellation and land restoration. Explore Jesus’s First Sermon (Luke 4), where he announced his mission to proclaim this “Year of the Lord’s favor” (Isaiah 61), threatening the Judaic creditor oligarchy. Contrast this with the pro-creditor stance of Rabbi Hillel, who introduced the prosbul clause, enabling creditors to circumvent the Jubilee debt cancellations.

Finally, witness how creditors' political power throughout history led to the decline of these clean-slate traditions. Even as late as 197 BC, the Ptolemaic ruler Ptolemy V Epiphanes proclaimed a fiscal debt amnesty, commemorated on the trilingual Rosetta Stone. Understand how this ancient wisdom contrasts sharply with modern financial orthodoxy, which favors the sanctity of debt, even when it leads to systemic crisis.

Short VIDEO LINK: Michael Hudson book from Peter Duke explainer at Substack (images below)

“First Principles” — Supported by Biblical and Ancient Archeology

(SOURCE): “The problem of debt backlogs was created with the invention of interest-bearing loans in agrarian 3rd Millennium BC Mesopotamia. The remedy of record was the royal Clean Slate proclamation or Jubilee Year of debt forgiveness. These proclamations had three functions: (1) They restored financial balance by annulling the backlog of crop debts that had accrued; (2) they liberated indebted bondservants (and their families); and (3) they restored land tenure rights, enabling debtors to continue living productively on the land, pay taxes, and be available for military service and corvée labor.

Clean Slate debt cancellations (the Jubilee Year), used in Babylonia since Hammurabi’s dynasty, first appear in the Bible in Leviticus 25. Jesus’s first sermon announced that he had come to proclaim it. This message – more than other religious claims – is what threatened his enemies, and why he was put to death.

This interpretation has been all but expunged from our contemporary understanding of the phrase, “…and forgive them their debts,” in The Lord’s Prayer. It has been changed to “…and forgive them their trespasses (or sins),” depending on the particular Christian tradition that influenced the translation from the Greek opheilēma/opheiletēs (debts/debtors). On the contrary, debt repayment has become sanctified and mystified as a way of moralizing claims on borrowers, allowing creditor elites and oligarchs the leverage to take over societies and privatize their public assets, especially in hard times.

Historically, no monarchy or government has survived takeover by creditor elites and oligarchs (viz: Rome). In a time of increasing economic and political polarization, and a global economy deeper in debt than at the height of the 2008 financial crisis, …and forgive them their debts shows what individuals, governments, and societies can learn from the ancient past for restoring economic and social stability today.”

Old Testament Oppressions by Money Changers — Debt — Courts — Ravenous Wolves Referred to in the Video Above

“… 1 Woe to her that is filthy and polluted, to the oppressing city! 2 She obeyed not the voice; she received not correction; she trusted not in the LORD; she drew not near to her God.. 3 Her princes within her are roaring lions; her judges are evening wolves; they gnaw not the bones till the morrow. 4 Her prophets are light and treacherous persons: her priests have polluted the sanctuary, they have done violence to the law. 5 The just LORD is in the midst thereof; he will not do iniquity: every morning doth he bring his judgment to light, he faileth not; but the unjust knoweth no shame. 6 I have cut off the nations: their towers are desolate; I made their streets waste, that none passeth by: their cities are destroyed, so that there is no man, that there is none inhabitant. 7 I said, Surely thou wilt fear me, thou wilt receive instruction; so their dwelling should not be cut off, howsoever I punished them: but they rose early, and corrupted all their doings. 8 Therefore wait ye upon me, saith the LORD, until the day that I rise up to the prey: for my determination is to gather the nations, that I may assemble the kingdoms, to pour upon them mine indignation, even all my fierce anger: for all the earth shall be devoured with the fire of my jealousy. 9 For then will I turn to the people a pure language, that they may all call upon the name of the LORD, to serve him with one consent. Zeph. 3.1-9 (KJV)

In Chapter 3 of Malachi God speaks about tithing practices of that time as actually robbing God. Four hundred years later, Christ Jesus admonishes the Pharisees with a “Woe to you hypocrites” explaining the paying of their tithes in mere culinary spices of mint, dill and cumin were not what God wanted or even requested … particularly when the tithes were actually levied as a temple tax by the priests and the money changing shulhani described below. The tithes were a tax levied against a people who were very poor. God through Malachi speaks of offering He wants: as being to the LORD, not men, and it being righteousness. Christ Jesus further explains that to be justice, mercy and faithfulness; “19. Do not store up for yourselves treasures on earth, where moth and rust destroy, and where thieves break in and steal. 20. But store up for yourselves treasures in heaven, where moth and rust do not destroy, and where thieves do not break in and steal. 21. For where your treasure is, there your heart will be also.” Readers are asked to consider this in the context of America in 2023 and the discussion of “money changers; the shulhani” which Christ Jesus confronted in the temple discussed below.

“Early Christian Jews were called the Ebionites, meaning 'the Poor'. P aul calls the early Christian Jews of Israel the Poor Saints of Jerusalem (Romans 15:26). Jesus, his brother James the Righteous and other writers of the New Testament including Rabbi Paul of Tarsus warn of the evils of wealth. Jesus often preached against Mammon, which is an Aramaic term for the wickedness of materialism and greed. In our culture and in our day and age we minimize this teaching of Jesus.

Money Changers at the Time of Jesus. [1]

The Bible records two instances of Jesus cleansing the temple of money changers and those selling sacrificial animals. Jesus’ first encounter with money changers was at the beginning of His three-year ministry (John 2:14–16). He made a whip of cords and drove them out. The second time He confronted the money changers was the week before His trial and crucifixion. Seeing that the money changers had come back, He again drove them out, saying, ““It is written, ‘My house will be called a house of prayer,’ but you are making it ‘a den of robbers’”” (Matthew 21:13).

Because Jewish law required a temple tax of a half-shekel (Exodus 30:11–16), Jews and visitors from other nations came to pay their taxes when they offered their sacrifices. But foreign coins with the likeness of pagan emperors would not be accepted in God’s temple. So money changers exchanged those foreign coins for Jewish money, but they did so at an exorbitant profit. Rather than provide this service as a business in another part of town, they exploited the religious zeal of the visitors to Jerusalem and did their business on temple grounds. Because they determined their own exchange rate, money changers easily took advantage of the poor and the foreigners pouring into Jerusalem for Passover.

These same money changers were associated with others who engaged in shady business practices in the temple courts. Some sold sacrificial animals, overcharging people who did not bring their own. Others were in charge of examining the animals to be sacrificed, and it was a simple matter to declare an animal “unapproved” and force the worshiper to buy another animal—at an inflated price—from the temple vendors. Such goings-on, exploiting the poor and the foreigner, angered the Lord Jesus and was strictly forbidden in the Mosaic Law (Exodus 22:21; Leviticus 19:34).

The money changers in the temple courts were similar to tax collectors in that they extorted money from their own people. They were more than ordinary businessmen. They were seeking to profit financially from the worship of God. Wherever passion and zeal are found, there will also be those who seek to profit from that zeal. Paul wrote to Timothy about such people, false teachers who found a way to make a fortune off the gospel (1 Timothy 6:5). Modern versions of the money changers flood the airways, promising to exchange your hard-earned dollars for blessings, healing, and God’s favor. For a suggested donation, they will supposedly pray for you or promise virtually anything you want. For another twenty bucks, they will sell you a book about how to wrangle prosperity, health, or spiritual insights from God. And, like the simony of the first-century money changers, the practices of modern religious price gougers only aid those worshipers who have enough cash to purchase their wares.

Paul often clarified the difference between his ministry and that of false teachers by pointing out their greed. In 2 Corinthians 2:17 he wrote, “Unlike so many, we do not peddle the word of God for profit. On the contrary, in Christ we speak before God with sincerity, as those sent from God.” Peter also warned that one way to spot a modern-day money changer is to notice his or her fascination with financial gain (2 Peter 2:3). Jesus hated the money changers’ exploitation of the devout two thousand years ago, and He still hates it. We may not have shady characters collecting temple taxes outside our places of worship, but we have them invading our homes through radio and television. We are wise to remember how Jesus reacted to such selfish swindlers. With no apologies, He drove them out of His Father’s house. When we identify a modern money changer, we should do the same.

Shulhani - Who Were These Money Changers?[2]

“Money changing was very common in the Roman Near East, where there was a proliferation of currency systems and standards. In Palestine, as in Egypt, each district had its basilikai trapezai ("royal bank") retained from Hellenistic times (Jos., Life 38), and probably each village had its own money changer (cf. Sif. Deut., 306).

In the period of the Second Temple vast numbers of Jews streamed to Palestine and Jerusalem "out or every nation under heaven" (Acts 2:5), taking with them considerable sums of money in foreign currencies. This is referred to in the famous instance of Jesus' driving the money changers out of the Temple (Matt. 21:12). Not only did these foreign coins have to be changed but also ordinary deposits were often handed over to the Temple authorities for safe deposit in the Temple treasury (Jos., Wars 6:281–2). Thus Jerusalem became a sort of central bourse and exchange mart, and the Temple vaults served as "safe deposits" in which every type of coin was represented (TJ, Ma'as. Sh. 1:2, 52d, and parallels). The business of money exchange was carried out by the shulḥani ("exchange banker"), who would change foreign coins into local currency and vice versa (Tosef., Shek. 2:13; Matt. 21:12). People coming from distant countries would bring their money in large denominations rather than in cumbersome small coins. The provision of small change was a further function of the shulhani (cf. Sif. Deut., 306; Ma'as Sh., 2:9). For both of these kinds of transactions the shulhani charged a small fee (agio), called in rabbinic literature a kolbon (a word of doubtful etymology but perhaps from the Greek κόλλυβος "small coin"; TJ, Shek. 1:6, 46b). This premium seems to have varied from 4 percent to 8 percent (Shek. 1:6, et al.). The shulḥani served also as a banker, and would receive money on deposit for investment and pay out an interest at a fixed rate (Matt. 25:27), although this was contrary to Jewish law.

Thus the shulḥani fulfilled three major functions:

(a) foreign exchange,

(b) the changing of large denominations into small ones, and vice versa, and

(c) banking. Three terms for "money-changer" are found in the New Testament: (a) kermatistēs (John 2:14), (b) kollybistēs (Matt. 21:12), and (c) trapezitēs (literally, shulhani; Matt. 25:27, et al.)

It seems probable that these three terms correspond to the three functions of the shulḥani outlined above. Thus kermatistēs, from kermatizō. "to cut small," is one who gives small change; kollybistēs, from kollybos, changed foreign currency; while the trapezitēs was a banker (from trapeza, "table").

The shulhanim in Jerusalem used to set up their "tables" in the outer court of the Temple for the convenience of the numerous worshipers, especially those from foreign countries (Matt. 21:12–13). Excavations around the Temple walls have uncovered stores or kiosks, some of which, it has been surmised, were occupied by money changers.

The Mishnah states that on the 15th of Adar, every year, "tables" were set up in the provinces (or in Jerusalem) for the collection of the statutory annual half-shekel, and on the 25th of Adar they were set up in the Temple itself (Shek. 1:3). The activity of the Jewish banker, shulhani, was of a closely defined nature, as his transactions had to be in accordance with the biblical prohibition against taking interest (ribit). The Talmud records much information relating to his activities. An additional and interesting feature of his business was the payment on request of sums deposited with him for that purpose (BM 9:12).

Footnotes:

[1] Who Were the Money Changers in the Bible? https://gotquestions.org

[2] Shulhani - Who Were These Money Changers? www.jewishvirtuallibrary.org

Thomas Jefferson | National Debt Not-Transferrable to Future Generations | 20 Year Limit Described as “Erosion of Topsoil” | “Usufruct”

“Intergenerational Justice in the United States Constitution, The Stewardship Doctrine”: by Attorney John Davidson

"Taking Turns" | A modern Parable

“Once upon a time, there was a small, neighborhood playground. The playground contained only one swing. The local children feuded continually over access to the swing until some parents finally stepped in and created a sign-up list. The list was kept by a local grandmother who liked to spend her afternoons on the sunny bench in front of the swing.

One day, a boy named Jimmy, who had signed up for the swing, became bored with swinging. Jimmy decided to stand up in the swing instead, and to jump up and down. Through his vigorous efforts, Jimmy made a great deal of noise, and he seemed to be greatly pleased with himself. But after a few minutes of this game, the swing set began to shake violently. The structure could not endure Jimmy's abuse much longer.

The grandmother rose from her bench. She asked Jimmy to stop jumping on the swing. Jimmy refused, protesting, "I can do whatever I want! I signed up! It's my swing right now! That's the rule!"

The grandmother shook her head. She explained to Jimmy, kindly but firmly, "No. That is not the rule. It is never your swing -- or anyone else's; it is only your turn on the swing. Other children have a right to play on the swing after you are done. So even though you are free to play on the swing, . . . you are not free to break it."

INTRODUCTION

The principle to which the grandmother alluded has wide application. Eventually, each of us now living will perish and depart this world. Our "turn" on this earth will come to an end. But the earth, and all it holds, will survive us, to be inherited by our descendants. It is due to this simple truth that we may never rightfully consider the world as wholly our world. We may each of us, and all of us collectively, enjoy the bounties of nature during our allotted time . . . but we may NOT break the swing.

This childhood lesson is easily forgotten. How else to explain the unsustainable conduct engaged in today by both public and private entities, conduct which degrades the water and air that are posterity's natural legacy? We allow the manufacture of radioactive wastes which will encumber the health of the land virtually forever, before we have developed safe disposal technologies for that waste. We deplete fresh water aquifers faster than nature can replenish them. We wash precious topsoil, built up over millennia, into the rivers and oceans, and poison what soil remains with bio-accumulating pesticides. We introduce thousands of previously unknown, synthetic chemicals into the environment without requiring testing for their long term effects upon humans and other life forms. Through all of these practices, and through reckless habitat destruction, we drive plant and animal species into extinction at a rate of thousands per year; irreversibly decimating entire ecosystems. We jeopardize the very existence of the human race. We then add insult to posterity's injuries by running up incredible public debts pledged on our children's credit in order to finance short term material interests. Through all of these practices, we damage that which does not belong solely to ourselves.

Though we can imagine better, sounder, more sustainable ways to conduct ourselves, we do not require such conduct of one another. Instead, we capitulate to the lowest common denominator, the crassest of values. We accede to short-sighted demands for expedience and profit, to claims of "title" and "property right," claims of sovereign privilege, claims based -- one and all -- upon Jimmy's Rule: "I can do whatever I want! It's my swing!" Inexplicably cowed by such arguments, we allow forests to fall, salmon to disappear.

The thesis of this article is simple: Jimmy's Rule is not the true law of this country. It never was, never will be, the law. Instead, it is the principle articulated by the grandmother - the principle of responsible, intergenerational stewardship - which has forever lain, inviolable and incontestable, at the root of all public and private property right in land and natural resources. It is a principle mandated by conscience, by common sense, and, happily, by the United States Constitution.

Introduction and relevant links to extensive writing:

SOURCE: Constitutional Law Foundation, https://www.conlaw.org/Intergenerational-Intro2.htm ©Constitutional Law Foundation, 50 West 36th Street, Eugene, Oregon 97405 Phone: 541-683-4500, Fax: 541-683-4492, clf@conlaw.org

Generational Sovereignty and Economic Right – The Problem of Inherited Debt

Summary:

When the government of one generation creates financial debts repayable by later generations, it engages in the quintessential act of taxation without representation. f195 Jefferson and many of his contemporaries found the practice to be unacceptable. As a Virginia planter, Jefferson conceived of all wealth as originating from the earth. He therefore viewed long-term debt as a violation of the usufructary limits placed on each generation's use of the land:

"[S]uppose Louis XV, and his contemporary generation had said to the money-lenders of Genoa, give us money that we may eat, drink, and be merry in our day; and on condition you will demand no interest till the end of 19. years . . .. The money is lent on these conditions, is divided among the living, eaten, drank, and squandered. Would the present generation be obliged to apply the produce of the earth and of their labour to replace their dissipations? Not at all." f196

And again:

"[The present generation] have the same rights over the soil on which they were produced, as the preceding generations had. They derive these rights not from their predecessors, but from nature. They then and their soil are by nature clear of the debts of their predecessors." f197

Jefferson also treated long term public debt as an issue of generational sovereignty:

"[T]he received opinion, that the public debts of one generation devolve on the next, has been suggested by our seeing habitually in private life that he who succeeds to lands is required to pay the debts of his ancestor or testator: without considering that this requisition is municipal only, not moral . . .. [B]ut . . . between society and society, or generation and generation, there is no municipal obligation, no umpire but the law of nature. We seem not to have perceived that, by the law of nature, one generation is to another as one independent nation to another." f198

On the basis of both lines of argument, Jefferson concludes that "[N]o generation can contract debts greater than may be paid during the course of it's own existence" and that "19 years is the term beyond which neither the representatives of a nation, nor even the whole nation itself assembled, can validly extend a debt." f199

While Madison may have had reservations as to Jefferson's theory that all laws and constitutions automatically expire in 19 years, he was more receptive to Jefferson's position on debts:

"The idea which the letter evolves is a great one, and suggests many interesting reflections to legislators; particularly when contracting and providing for public debts. . . . [I]t would give me singular pleasure to see it first announced in the proceedings of the U. States, and always kept in their view, as a salutary curb on the living generation from imposing unjust or unnecessary burdens on their successors." f200

In a piece for the National Gazette, dated January 31, 1792, Madison argued that "each generation should be made to bear the burden of its own wars, instead of carrying them on, at the expence of other generations." f201 Later, in his second Inaugural Address, he advocated a luxury tax, observing that, "In time of war, [the tax] may meet within the year all the expenses of the year, without encroaching on the rights of future generations, by burdening them with the debts of the past."f202

President Washington, in his farewell address, similarly reminded the young nation to avoid "accumulation of debt . . not ungenerously throwing upon posterity the burthen which we ourselves ought to bear."

Other direct references:

A Ancient Greece, Rome, and the Old Testament.

Greece and Rome The Old Testament …E Generational Sovereignty and Economic Rights - The Question of Inherited Public Debt.

In pertinent part, the author John Davidson’s Article also quotes:

“… [J]efferson maintains that re-ratification of constitutions and other legislation is required once every generation, and he defines a generation as the period after which a majority of those alive at the time of a law's passage shall themselves have passed away. Applying tables of mortality from the period, Jefferson calculates that:

"Every constitution, then, and every law, naturally expires at the end of 19 years. If it be enforced longer, it is an act of force, and not of right." f185

In addition to his philosophic argument for expiring old laws and constitutions, Jefferson makes certain practical arguments. Like (Algernon) Sidney (in “Discourses on Government 1683”, he stresses the need for governmental institutions to keep pace with the evolution of human reason and understanding, f186 and he identifies periodic re-constitution and re-legislation as mechanisms for insuring that evolution. On practical grounds, he rejects the opportunity for amendment or repeal as an adequate substitute for the requirement of expiration and re-ratification. f187

The same principles which invalidate perpetual constitutions and hereditary monarchies also invalidate, by implication, other perpetual legislation. Complementing the generational right of re-constitution, then, must be a generational right of re-legislation. Paine had applied the principle of generational sovereignty to ordinary legislation in a 1786 communication to the Pennsylvania legislature, in language which closely anticipated the tone of Jefferson's 1789 letter to Madison. Defending the state's right to revoke the Bank of North America's charter, Paine explained that a perpetual charter could not exist:

"As we are not to live for ever ourselves, and other generations are to follow us, we have neither the power nor the right to govern them, or to say how they shall govern themselves. . . . [It is] the summit of human vanity . . . to be dictating to the world to come." f188

He went on to suggest that 30 years was the average length of a generation, that any public act could not be in force longer than that term, and that it would be useful to have an explicit notation to that effect in the constitution. f189

Reflecting the same general philosophy, numerous state constitutions forbade the legislative creation of perpetual or hereditary privileges. f190” …

Analogy to Topsoil Depletion

“The contemporary issue to which Jefferson's arguments most literally apply is the problem of topsoil depletion. As a planter in predominantly agrarian Virginia, who tended to view wealth as the direct or indirect product of the earth, f130 it was natural for Jefferson to phrase his discussions of intergenerational relations -- even intergenerational economic relations -- in terms of soil:

"Are [later generations] bound to acknowledge [a national debt created to satisfy short-term interests], to consider the preceding generation as having had a right to eat up the whole soil of their country, in the course of a life . . .? Every one will say no; that the soil is the gift of God to the living, as much as it had been to the deceased generation; and that the laws of nature impose no obligation on them to pay this debt." f131

Jefferson asserts that each generation has the right to inherit, undiminished, the same topsoil capital that its predecessors enjoyed. f132

Our society's failure to recognize and defend this most basic principle of intergenerational fairness during the past century has resulted in topsoil depletion that has reached crisis proportions. Soon we may have literally and irreparably "eaten up the whole soil of our country." f133

Of course, the principle applies to a myriad of resources other than soil. For instance, the extermination of a salmon fishery, through shortsighted hydropower, irrigation or logging policies, would also constitute an "eating up of usufruct," as would the depletion of a freshwater aquifer that takes centuries to recharge itself. f134…”

Current Day Ramifications in the Lakes Region of providing a “Clean Slate” Total Debt Release to Americans

This may be the subject matter of a continuation blog post dealing with two questions:

How would community members’ lives improve IF “Rent Burdens” Disappear?

How would community members’ lives improve IF “Debt Burdens” Disappear?